Real Tips About How To Build An Amortization Schedule

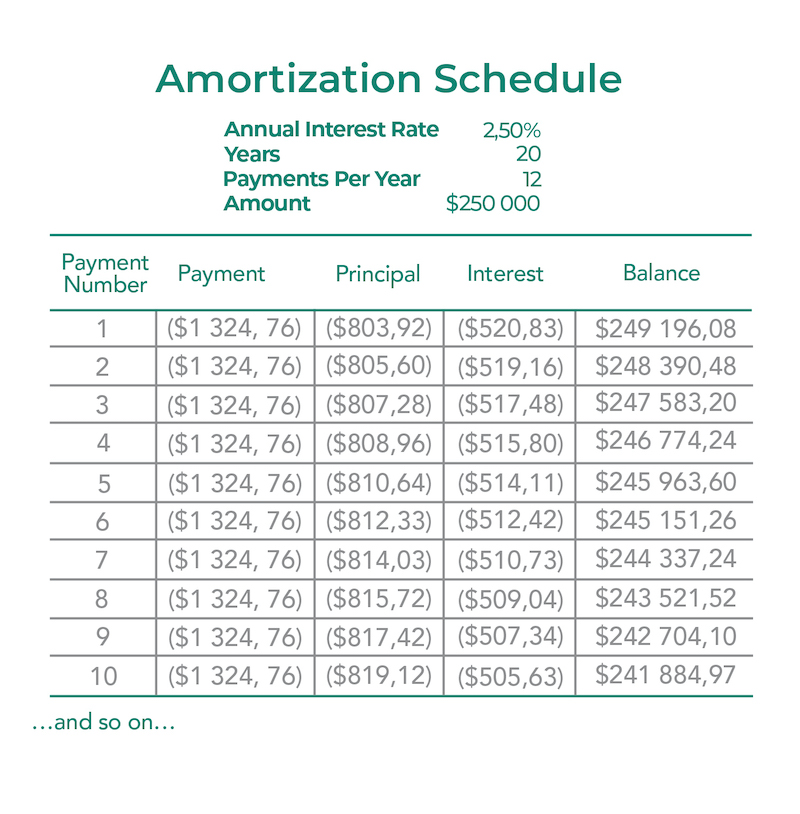

First enter the amount of money you wish to borrow along with an expected annual interest rate.

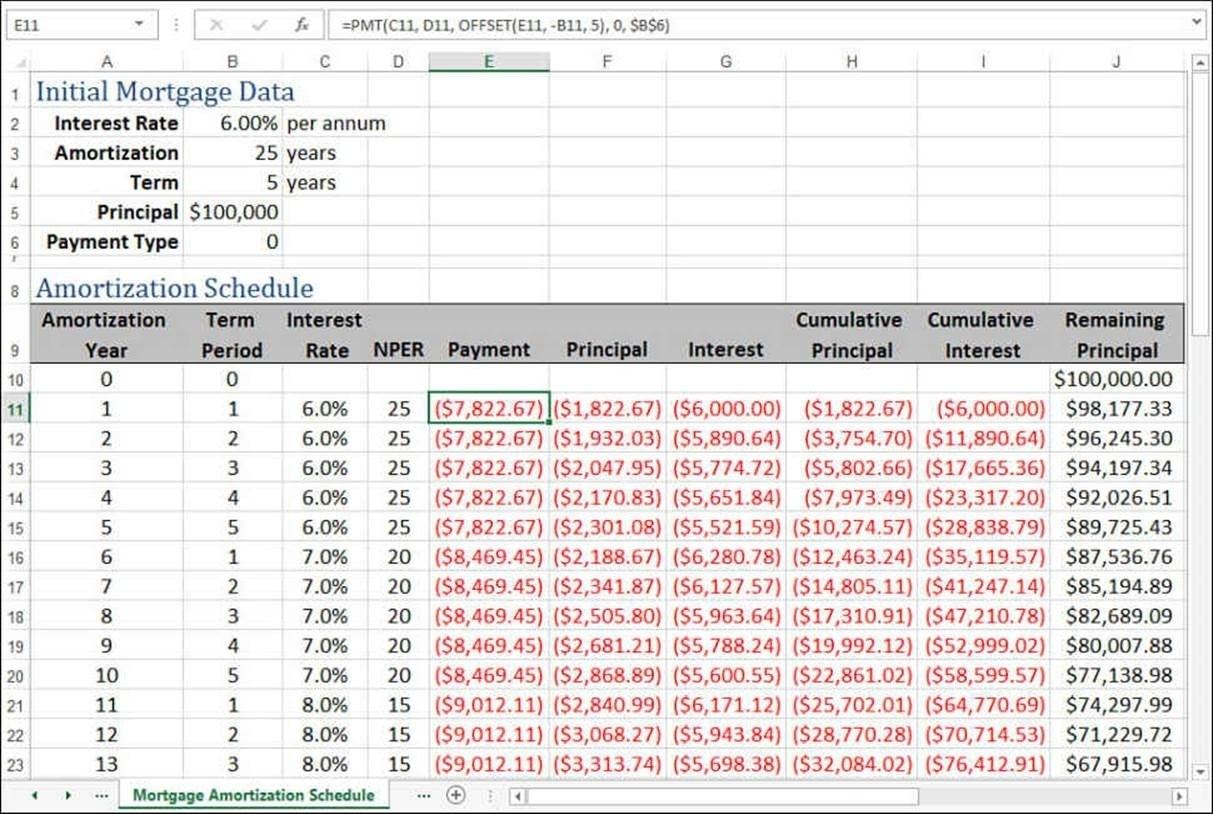

How to build an amortization schedule. Click ‘file’ in the upper left corner. Each calculation done by the. Understanding amortization schedules is crucial for managing a mortgage.

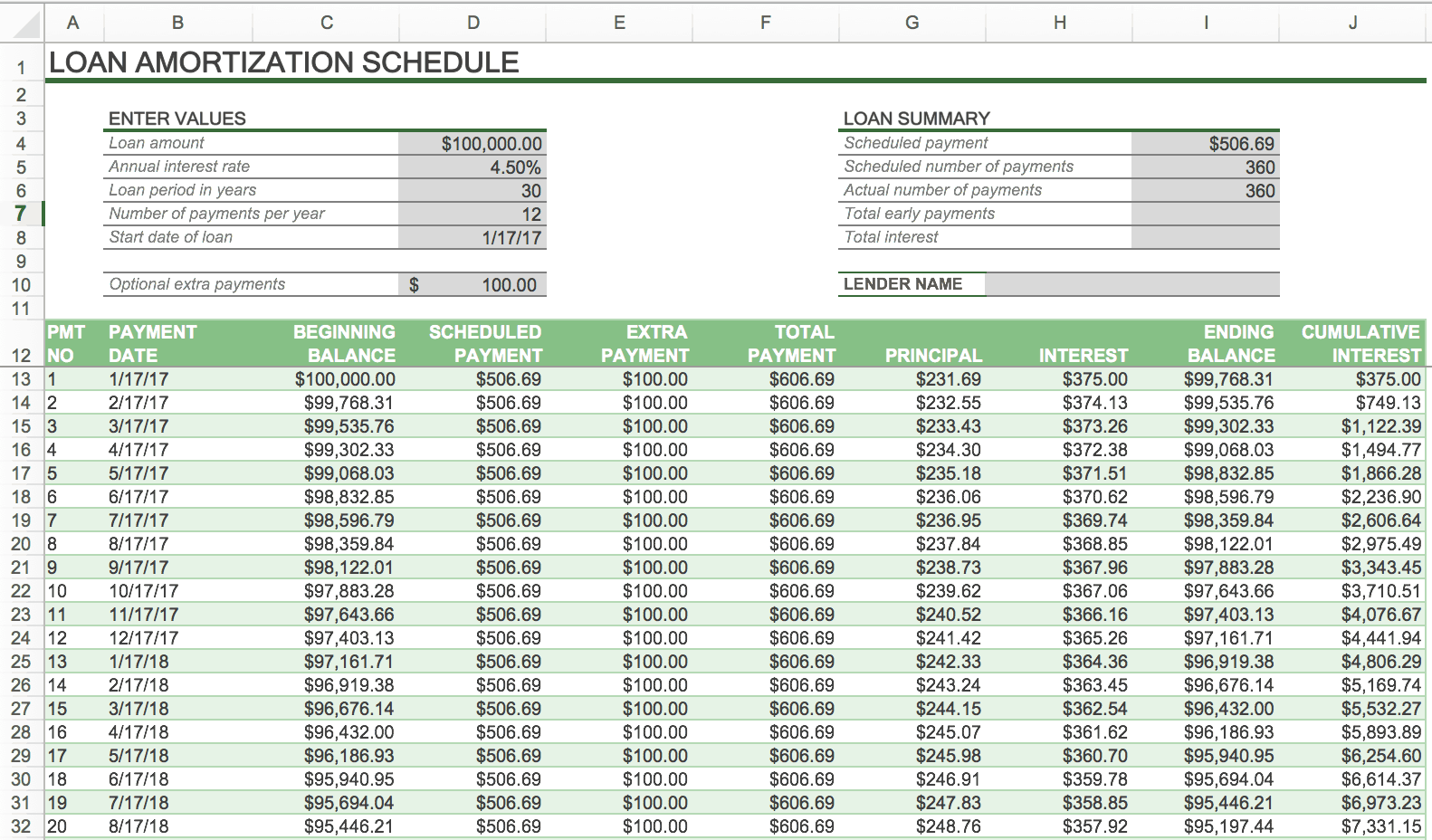

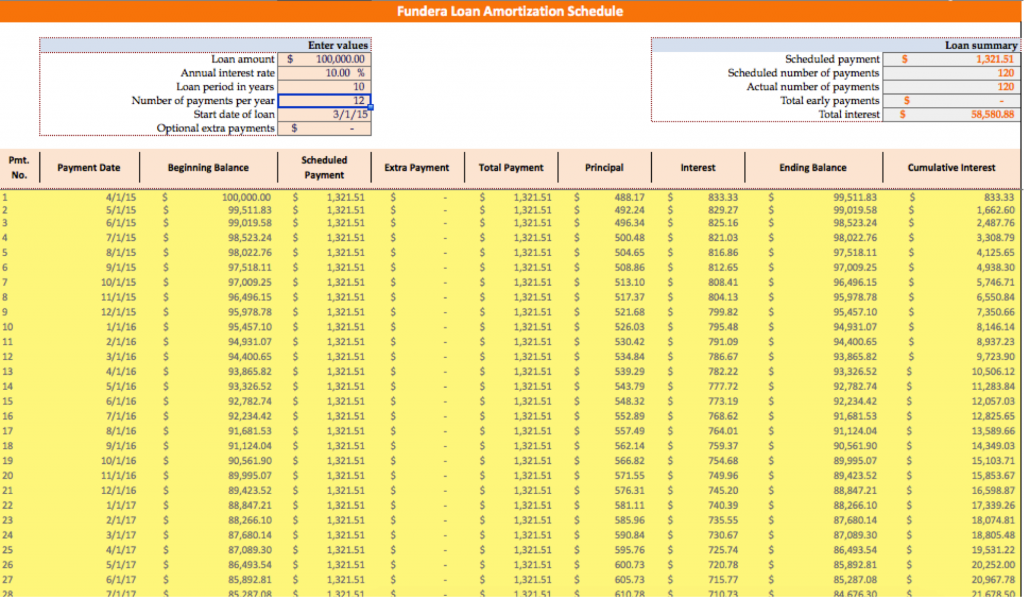

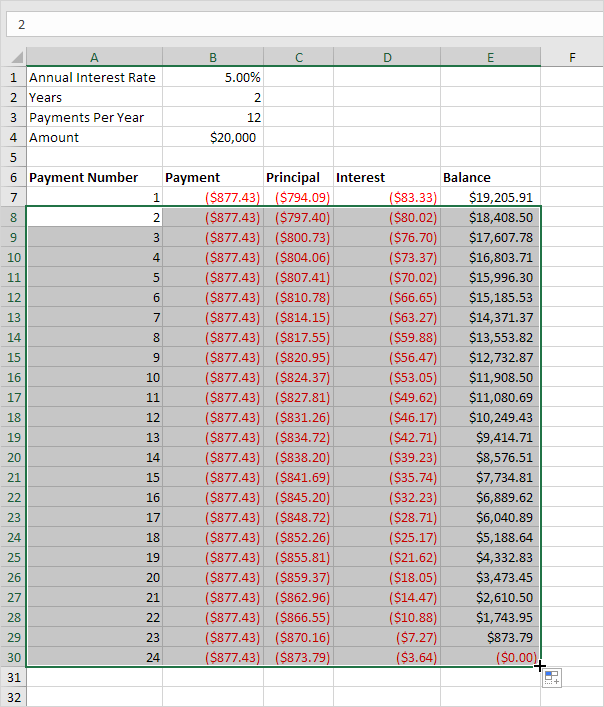

Create an amortization schedule payment table for loans, car loans and mortgages. Creating the basic outline of the google sheets mortgage amortization schedule spreadsheet. An amortization schedule calculator shows:

Amortization schedules are important for understanding loan repayment schedules for individuals and businesses. 196 rows an amortization schedule (sometimes called an amortization table) is a table detailing each periodic payment on an amortizing loan. Excel is a powerful tool for visually seeing how a loan will be paid off over.

Amortization schedules are used by. How much principal and interest are paid in any particular payment. Amortization typically refers to the process of writing down the value of either a loan or an intangible asset.

Loan amortization schedule refers to the schedule of repayment of the loan in terms of periodic payments or installments that comprise of principal amount and interest. It's relatively easy to produce a loan amortization schedule if you know what. To create an amortization schedule by hand, we need to use the monthly payment that we've just calculated above.

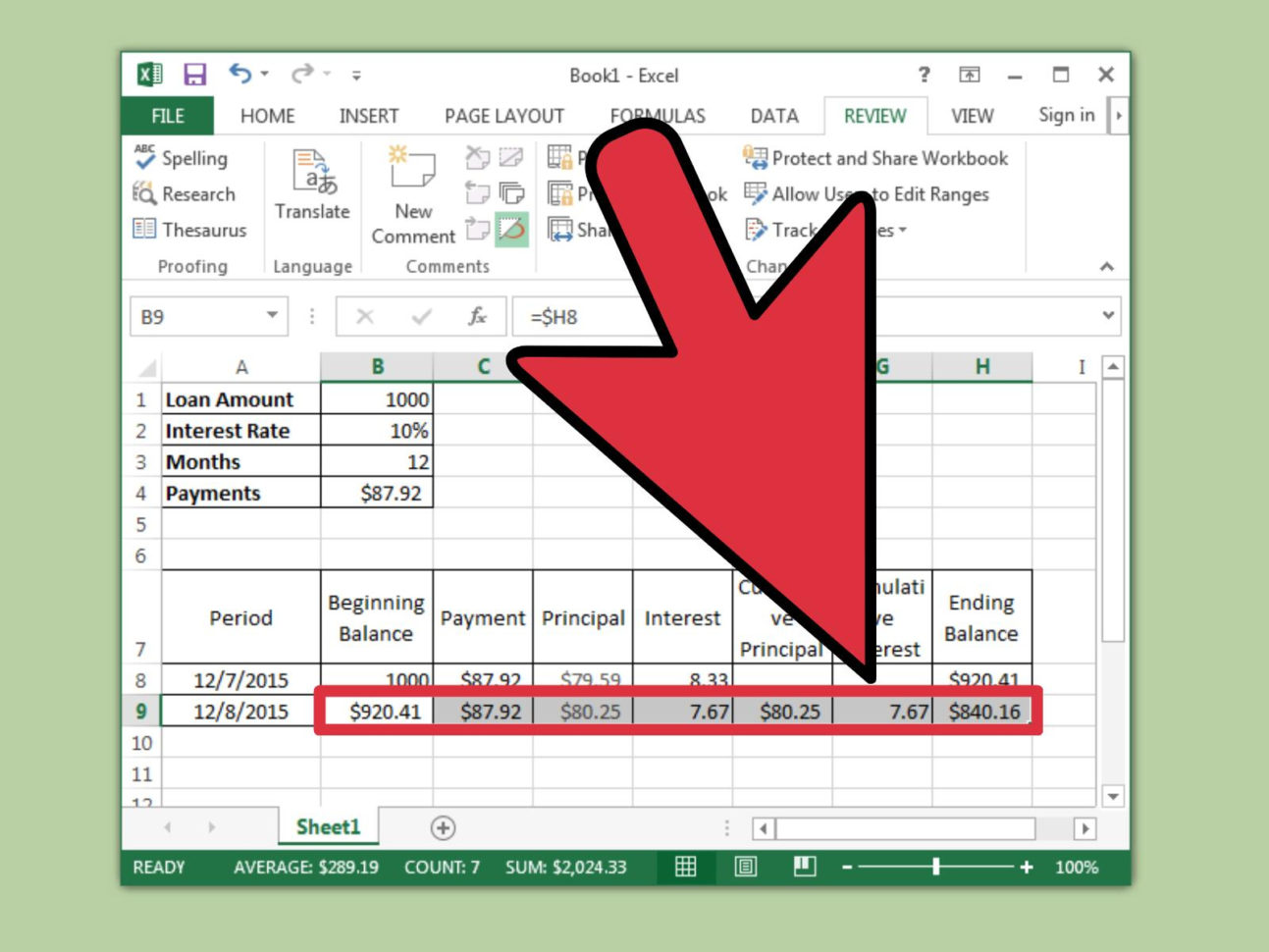

An amortization schedule, sometimes called an amortization table, displays the amounts of principal and interest paid for each of your loan payments. Excel navigation knowledge panel. How to calculate a loan amortization schedule if you know your monthly payment.

Creating an amortization schedule in excel is simple. Using excel to create an amortization. The loan amortization schedule outlines.

Create the proper labels in column a to help keep. How do you calculate amortization? Enter loan amount, interest rate, number of payments and payment.

A loan amortization schedule breaks down each periodic payment into its components, helping both borrowers and lenders understand the loan repayment. To create an amortization schedule, first, open excel and make a new spreadsheet. You can also see how much you still owe on the loan at any given time with the outstanding balance after a payment is made.

How to calculate a loan. Then input a loan term in years and the payment interval. How to create an amortization schedule with excel.

![Free Printable Amortization Schedule Templates [PDF, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/04/amortization-schedule.png?gid=37)