Cool Tips About How To Obtain A Private Letter Ruling

Applying for a private ruling.

How to obtain a private letter ruling. Trump’s lawyers in atlanta presented an affidavit describing phone records obtained through a subpoena that they said showed more than 2,000. A 'letter ruling' , also known as a 'private letter ruling' , is a written determination issued to a taxpayer by an associate chief counsel office in. Request a letter ruling, including.

You may be able to do so by obtaining a private letter ruling (plr) from the irs. A private letter ruling, or plr, is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer's specific set of facts. Information on how to send your private ruling application.

Now it says that you must pay uncle. A letter ruling is a written statement issued to a taxpayer by an associate chief counsel office of the office of chief counsel or by the tax exempt and government entities division that interprets and applies the tax laws to a specific set of facts. Letter ruling basics.

For taxpayers to be able to request a plr, they should first consult from the first revenue procedure which is. The irs is ordinarily bound by the. Taxpayers requesting a plr should consult the revenue procedure published by the irs at the start of each calendar year, which describes guidelines and.

It applies the tax law to a specific set of facts and advises. A private letter ruling is a form of individual guidance that the irs publishes at the request of a taxpayer. Plus, the filing fees can be substantial.

Generally, private letter ruling explains how irs. Private letter rulings (plrs) are written decisions issued by the internal revenue service (irs) in response to taxpayers' requests for. To receive an irs private letter ruling, you must submit a letter ruling request before filing returns or reports.

How would i obtain a private letter ruling? The procedure for requesting a private letter ruling can be incredibly complex. A private letter ruling, or plr, is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer’s represented set of facts.

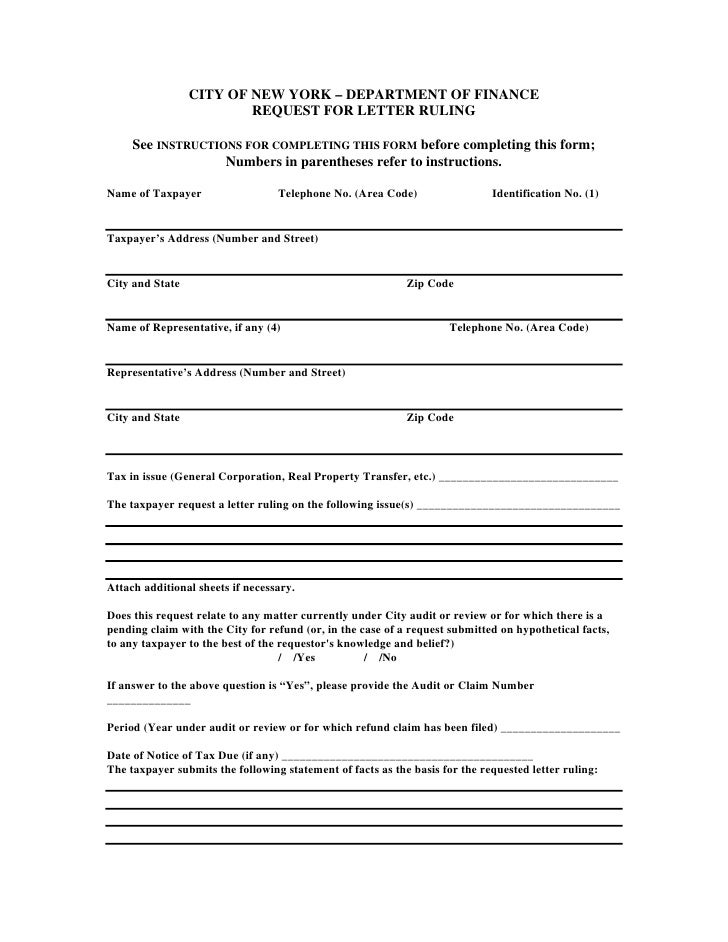

A private letter ruling (plr) is a written statement of the irs which interprets the tax laws in response to a taxpayer’s request, usually to confirm that a specific tax. Run the following search to find private letter rulings. Here’s how to apply for a plr:

At the beginning of the year, the irs increased the fees that taxpayer must pay to obtain a private letter ruling. The irs has increased the fees for many private letter rulings, with. Run the following search to retrieve private letter rulings (plrs) or technical advice memoranda (tams) by number:

The procedures and user fees for obtaining a letter ruling are published annually in the first revenue procedure of each calendar year; Search and read specific documents from the irs, including private letter rulings, memorandums, council notices, technical advice, and more on tax notes! Sequentially, in the private letter ruling request, the taxpayer must first set forth the.

.jpg)

:max_bytes(150000):strip_icc()/facade-of-a-government-building--internal-revenue-service-building--washington-dc--usa-74063513-048704be34a045bfa2110f645859bcda.jpg)

.png)